Full Claims Lifecycle Support Under One Roof, Part 1: Pre-Adjudication

The property insurance claims industry is currently experiencing a major evolution that seems to be impacting business from all directions. Claims professionals feel the pressure of increasing customer expectations alongside increasing trends in claims surges. On the internal side of the business, experienced adjusters and contractors are leaving the industry, which is creating a significant staffing shortage at a time when incoming workforce expectations and demands are changing.

If you’re a leader in claims operations, you’re feverishly assessing solutions and technology that can help you:

- Insurance carriers should create a best-in-class experience for policyholders.

- Establish a manageable claim process for claims professionals that contributes to job satisfaction.

- Fast track customer claims to shorten processing time.

- Reduce loss adjustment expense (LAE).

Adapting to a New Claims Adjuster Workforce

One significant change that carriers are making to adapt to this new claims environment is to shift the focus of the traditional field adjuster role to a more desk-oriented position. Today’s claims adjuster coordinates and acquires accurate supporting resources to precisely adjudicate a claim and manage the policyholder relationship from first notice of loss to full restoration.

The Claims Technology Transformation

In this shifting claims model, carriers and adjusters have become more reliant on emerging insurance technology (InsurTech) to improve communication, reduce expenses, and ideally, streamline the claims process. However, the result so far has been a fragmented network of technology partners that is cumbersome for desk adjusters and leaders to manage. Desk adjusters are experiencing the fatigue of backlogged claims while they chase down contacts and piece together inconsistent or disjointed assessment records. Claims leaders are equally frustrated by quality control issues and wasted time bouncing between vendors.

Insurance companies that are leading the way in customer and staff satisfaction are turning to trusted partnerships with reliable claims support specialists like Hancock Claims Consultants.

In one call, Hancock Claims relieves the pressure by providing access to a full suite of tech-enabled services and a nationwide network of reliable experts. As a result, our carrier partners have benefited from time-saving efficiencies, reliable and accurate services, and satisfied policyholders nationwide.

How Hancock Uses Tech to Close Claims Faster—and Keep Them Closed

The needs of today’s successful desk adjuster go way beyond an on-site ladder assist. Hancock has evolved with those needs by investing heavily in claims technology and integrations that plugin with an insurer’s existing tech stack. As a result, we deliver improved efficiency and accuracy across our full suite of claims lifecycle services, from pre-adjudication to post-adjudication.

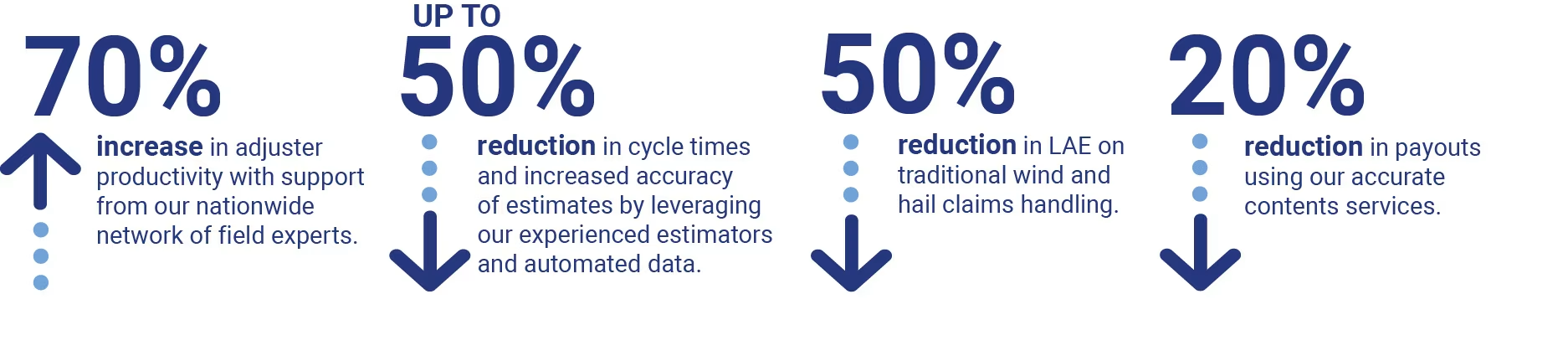

Our tech-forward approach has helped our carrier partners achieve the following KPIs:

Accelerate Pre-Adjudication with Streamlined Tech

For the remainder of this blog, we’re going to take a detailed look at how we use technology to accelerate the three major pre-adjudication steps and support streamlined workflows for desk adjusters. These solutions lead to fast-track insurance claims and a better experience for claims professionals and customers.

Property Inspections

Using our instant scheduling technology, desk adjusters have on-demand access to a nationwide network of 500 technicians who are available within 24 to 48 hours. In the face of a sudden claims surge, your claims team can scale quickly by scheduling interior and exterior inspections online or through our call center. From there, automated text and email notifications can be customized to keep carriers, adjusters and policyholders in the loop as much as necessary regarding scheduling and reporting. Excellent communication and fast track inspection services help speed up the process while offering all stakeholders a good experience.

Hancock’s team of certified, cost-effective technicians for roofs, exteriors and interiors are trained to ensure accuracy, accountability and professional customer service. Carriers can trust that their customers will be well cared for, and desk adjusters can move claims forward faster by eliminating back and forth with independent contractors. Offering additional services like ladder assist and emergency tarping and boarding services, Hancock has your inspections covered.

Estimations

Using the leading field-to-desk technology, our team of field inspectors can deliver accurate information directly to desk adjusters. While on-site, inspectors use an intuitive mobile app to navigate each step of the estimation process, ensuring precision and consistency with your company’s requirements.

Through our comprehensive evaluation process, Hancock provides:

- Detailed photo reports with captions clarifying on-site inspection findings.

- Accurate measurements of roofing, exterior, and interior damages.

- Damage repair estimates are rendered based on individual carrier estimating guidelines.

All information is packaged and sent to the desk adjuster, giving them everything needed to make well-informed claim decisions while cutting cycle time in half.

Contents Services

It’s common for the claims process to stall at the point of contents evaluation. When a policyholder looks at their belongings, they don’t see the fair market value. Reasonably, they see the emotional value, especially at a time when emotions are raw.

Hancock’s contents specialists serve as an objective third party, providing a compassionate helping hand to policyholders. Our specialists can deploy anywhere in the U.S. to help policyholders accurately assess and value their loss.

Every inspector arrives with a tablet loaded with inventory software that helps them quickly produce accurate inventory lists and valuations for each item. A real-time feed connects desk adjusters to each item uploaded into the database. Our experts freeze the list on-site, ensuring the inventory is accurate and no items are added post-evaluation. If a list already exists or on-site service is not needed, we will research and assign a value to each item for you.

Without leaving their office, desk adjusters can indemnify the policyholder faster and with confidence, the claim is closed for good.

Full Claims Lifecycle Support Under One Roof – Part 2: Post-Adjudication

We’ve talked about the evolution of the property claims industry. Insurers are dealing with a lot right now in keeping up with demand from extreme weather, progressing customer expectations and a tightening workforce. Claims leaders and adjusters are leaning into tech with varying levels of success due to a fragmented, cumbersome network of providers.

Here is a recap of how Hancock Claims is using streamlined tech and service solutions to relieve the pressure and help accelerate pre-adjudication with clarity and accuracy.

Property Inspections

- Our custom claims management system helps claims teams scale quickly by enabling 24/7 online scheduling of interior and exterior inspection services.

- Desk adjusters have on-demand access to our nationwide network of 500 techs who are available within 24 to 48 hours.

- Automated notifications can be customized to keep carriers, adjusters and policyholders up to date on scheduling and reporting.

Estimations

- Using leading field-to-desk estimation technology, Hancock’s field inspectors provide complete, accurate information to your desk adjusters in real-time.

- Claims cycle times are reduced by half with faster carrier-directed estimates.

Contents Services

- Hancock’s team of trained contents specialists can deploy anywhere in the U.S. to provide an objective helping hand in accurately assessing and valuing a policyholder’s loss.

- A real-time feed connects desk adjusters to each item uploaded into the database, so indemnification can be completed quickly and fairly.

Post-Adjudication: How We Use Streamlined Tech to Get the Claim Closed Faster

Finalizing a claims decision to move it to post-adjudication on our way to full restoration can become a long, drawn-out process. A desk adjuster needs to be able to look at a complete report to be certain about the origin of damages and what it will truly take to return the policyholder to a pre-claim state. But, finding qualified engineers and experts who know and understand the insurance industry is difficult and time-consuming.

Preferred Expert Services

Hancock’s Preferred Expert Services provides skilled engineers, building consultants, appraisers and other qualified professionals to support adjusters in the decision-making process for their claims. These experts help identify the cause of damage, determine how long the damage has existed, advise adjusters on necessary repair or replacement, and help negotiate the cost of loss. We can also provide post-repair inspections and Clerk of the Works services.

When the need for structural evaluations and specialized experts arises, a desk adjuster can, in one step, initiate Hancock’s process to assist quick and accurate claims resolutions:

- Make a request: The desk adjuster submits the details of the claim via Hancock’s online form to help us determine what type of expert is needed for the specific problem.

- Deploy support: Hancock engages an engineer or other pre-approved specialist from our nationwide network and supplies them with all the pertinent information, so they can quickly evaluate the project and move toward a resolution.

- Plan & communicate: Hancock shoulders the load of coordinating a time between the expert, the contractor and the policyholder to update estimates or accomplish specific needs.

- Receive updates: Our specialized experts leverage technology to load data automatically for the desk adjuster. Hancock is also able to track when regular updates or information is pending or past due.

- Evaluate with confidence: We confirm that the report has all the necessary elements so the adjuster can make a complete and informed claim decision the first time.

- Finalize plans: When repairs are approved and engineers are required, our network can also draft permitting plans to move each claim closer to resolution.

Hancock leverages technology every step of the way to manage all communication and automate workflows. This keeps carriers and adjusters in the loop on provider assignments, inspection updates, report communications and invoicing.

Preferred Repair Network

Once a claims decision is complete and it’s time to begin restoring the policyholder to their pre-claim state, finding a dependable, trusted contractor is notoriously tricky. Experienced adjusters have worked with some that excel and some that don’t when it comes to timeliness, cost and follow-through.

Hancock’s Preferred Repair Network is a nationwide network of highly qualified insurance contractors and repair professionals. From asbestos mitigation and roof restoration to plumbing and electrical, it’s rare to request contractor or other vendor assistance that falls outside of the scope of Hancock’s Preferred Repair Network.

We also rigorously vet each company to ensure their licensure, insurances and performance record meet our standards. No matter where your claim is located, we can help you find the right contractor to meet your service expectations.

Similar to the Preferred Expert Services network, a desk adjuster can initiate repair work in one simple step and connect with highly qualified insurance contractors and repair professionals to ensure quality repairs and shortened cycle times:

- Make a request: The desk adjuster submits the details and location of the work through our simple online form, XactAnalysis or Symbility. This arms us with the information we need to find the ideal contractor for the job.

- Deploy support: A Hancock specialist scans our network and narrows down the list of best-use providers. Once a contractor is selected, they are assigned to your case and given all the information needed to complete the assignment.

- Evaluate with confidence: The contractor delivers an official estimate for review, and the project scope and cost are analyzed and approved by all parties.

- Authorize the work: The final approval is given through official authorization and the work begins.

- See the job through: Hancock monitors the job to ensure the contractor fulfills all obligations and completes the agreed-upon work on time and on budget.

Hancock’s claims technology integrates with your internal systems to automate communications and ensure that everyone stays in the loop. Things like scheduling, progress and completed work are communicated to policyholders and adjusters.

Reducing Stress and Cutting Cycle Times Through Expert Partnerships

Carriers and adjusters can now spend less time sifting through a database of various service providers and tedious details by leaning into a centralized suite of services all provided Under One Roof.

Hancock Claims Consultants is proud to work alongside our industry’s top tech partners, expert technicians and skilled service providers. We are dedicated to unifying them into a single claims service ecosystem that creates ease and efficiency for our carrier partners.

See how all of Hancock’s services come together to provide Full Claims Lifecycle Support Under One Roof.

logy to quickly deploy engineers and contractors from our vast network. And also, how we’re improving the desk adjuster and policyholder experience through automated communication tools.