Professional CAT claim adjusters face numerous challenges when it comes to claims processing. Handling a large volume of claims during major events can quickly become a chaotic undertaking. With the right technology and partners, CAT adjusters can streamline processes and close claims efficiently.

External Challenges Adjusters Face During Catastrophic Events

Natural disasters: Climate change poses an increased risk of natural disasters. Instances of hurricanes, wildfires and floods are all on the rise. Significant damage to homes and personal property requires cat claim adjusters to process high claims volumes in short periods of time.

NOAA tracks natural disasters and weather events alongside costs. In 2022 alone, 18 separate events exceeded $1 billion dollars in damage, according to their report. For context, they have been tracking these events since the 1980s, and the frequency is quickly increasing.

In the 1980s, an average of three major events occurred each year. In the 2000s, there were just under seven major events annually. Now, we are looking at figures in the 20s with consistent growth. Thus, catastrophe adjusting must rely on technology and better planning to remain efficient and effective.

2. Rising construction costs: Volatile supply chains increase construction material and labor costs, eroding predictability in pricing for repairs and home rebuilds. Adjusters require a deep understanding of costs to accurately estimate against damage.

2022 started the year with an 8% increase in building costs. This is after prices rose 33% from the onset of the pandemic. Labor costs also spiked in response to high demand due to a labor shortage.

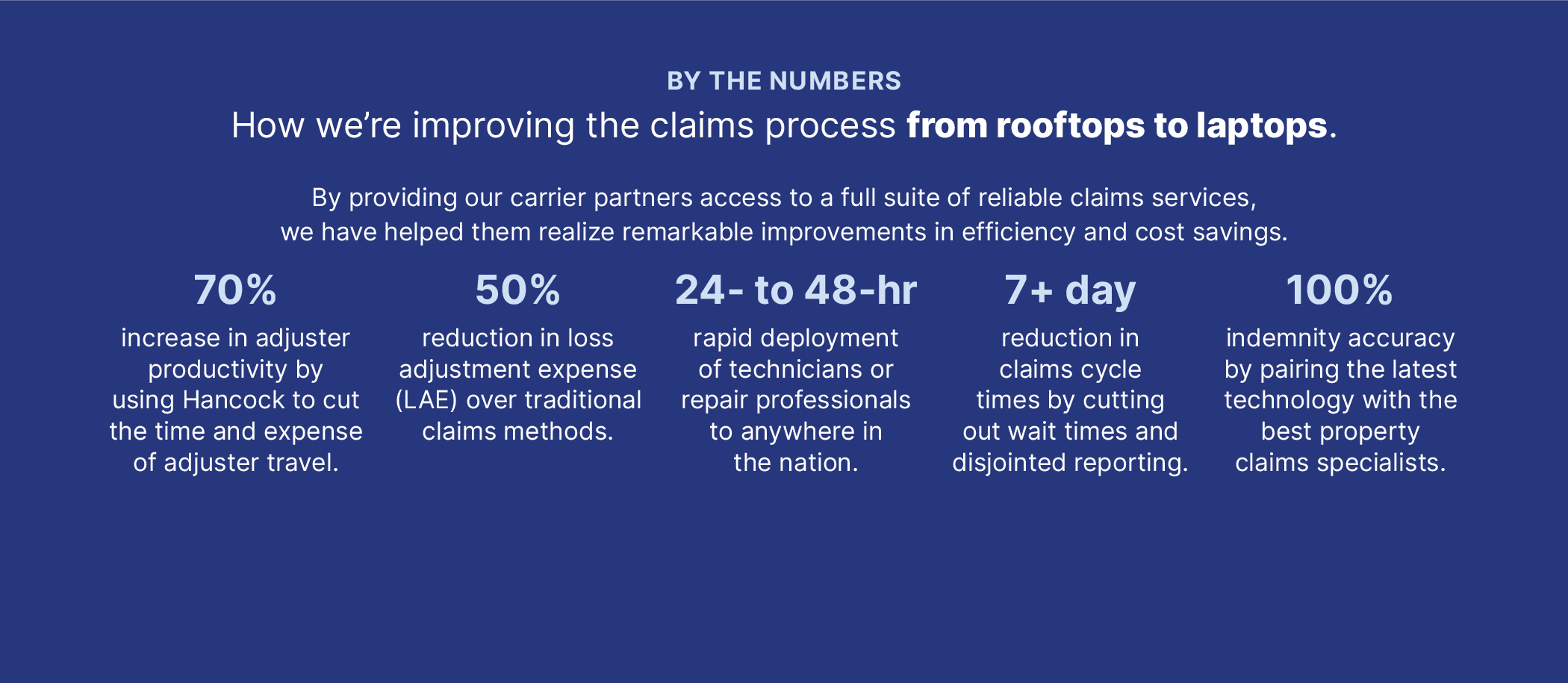

Utilizing a network of engineers and contractors with transparent pricing enhances adjusters’ ability to effectively manage costs. The data and reporting from Hancock Claims’ Preferred Repair and Preferred Expert Networks equips adjusters with actionable information on the average order value and results of the network.

Moreover, adjusters can loop in additional services like ladder assist to save time and costs. The Under One Roof story demonstrates how technology and services across the full claims cycle can help manage rising costs and reduce cycle time.

3. Technology advancements: The tech landscape is constantly changing, and adjusters will need to stay up to date on the latest tools and software for efficient claims processing. The challenge with new tech is the learning curve and implementation for adjusters.

The best technology is intuitive and designed to serve adjusters without a steep learning curve. At Hancock Claims Consultants, we leverage technology to support CAT adjusters and save them time and effort.

4. Fraud: Insurance fraud is an ongoing issue, and adjusters must remain vigilant to detect and prevent fraudulent claims. This may require additional investigation and resources, which can slow down the claims process.

Fighting fraud without bogging down claims resolutions is easier when using skilled claims appraisal specialists. When fraud investigations are triggered or claims are reopened by policyholders, having a cost-effective means of support is ideal.

5. Policyholder expectations: With the rise of digital communication, customers expect quick and efficient service. Adjusters will need to be able to handle a high volume of claims and provide clear communication to meet customer expectations.

In fact, 68% of all insurance complaints originate with a claims issue. Policyholders expect near-instant communication. And while this may seem unrealistic, technology can actually streamline information delivery.

With the right systems and partners, information can travel directly from the field to the adjuster and then to policyholders with minimal manual input.

Overall, the biggest challenges facing home insurance adjusters in 2023 are likely to be related to natural disasters, rising costs, technology advancements, fraud and customer expectations.

Internal Challenges Weighing Down Adjusters

Adjusters face challenges beyond the realm of external influences like natural disasters and fraud. Managing everything from emotional stress to work-life balance factors into the long list of adjuster challenges.

Emotional Stress and Personal-Life Balance as a CAT Adjuster

Working as a CAT adjuster is a rewarding experience, but the big events also take an emotional toll. Families can lose their home and sentimental valuables in an instant, and adjusters are dealing with the aftermath of these situations.

Even individuals highly capable of separating work life from personal affairs will have moments of emotional stress while processing claims. These claims surges also call for overtime and long days to reach processing goals.

We provide internal resources to help our team cope with trauma, and we encourage everyone in the industry to offer a helping hand to their adjusters and team members. Ready.gov has a great guide to help you recognize stress and trauma along with a Disaster Distress Helpline.

Time Management

Stress often compounds under difficult timelines and workloads. Traditional adjuster roles split time between the field and desk as a means of gathering information and processing claims.

By leveraging technology, adjusters can receive that same field information in the form of photos, videos, and drone footage and instantly uploaded reports without leaving the office. Processing claims faster mitigates common time-management issues.

On the backend of claims processing, managing contractors and expert services is traditionally time intensive as well. Sourcing qualified contractors, scheduling, completing work and issuing payments is a major black hole for time.

With a trusted partner like Hancock, adjusters can save time because we climb the roofs, offer a network of vetted contractors, and manage compliance and payments.

Full Claims Lifecycle Under One Roof

With Hancock Claims Consultants, CAT adjusters are empowered to reduce cycle times while improving claimant satisfaction. Reach out to learn more or schedule support directly online.